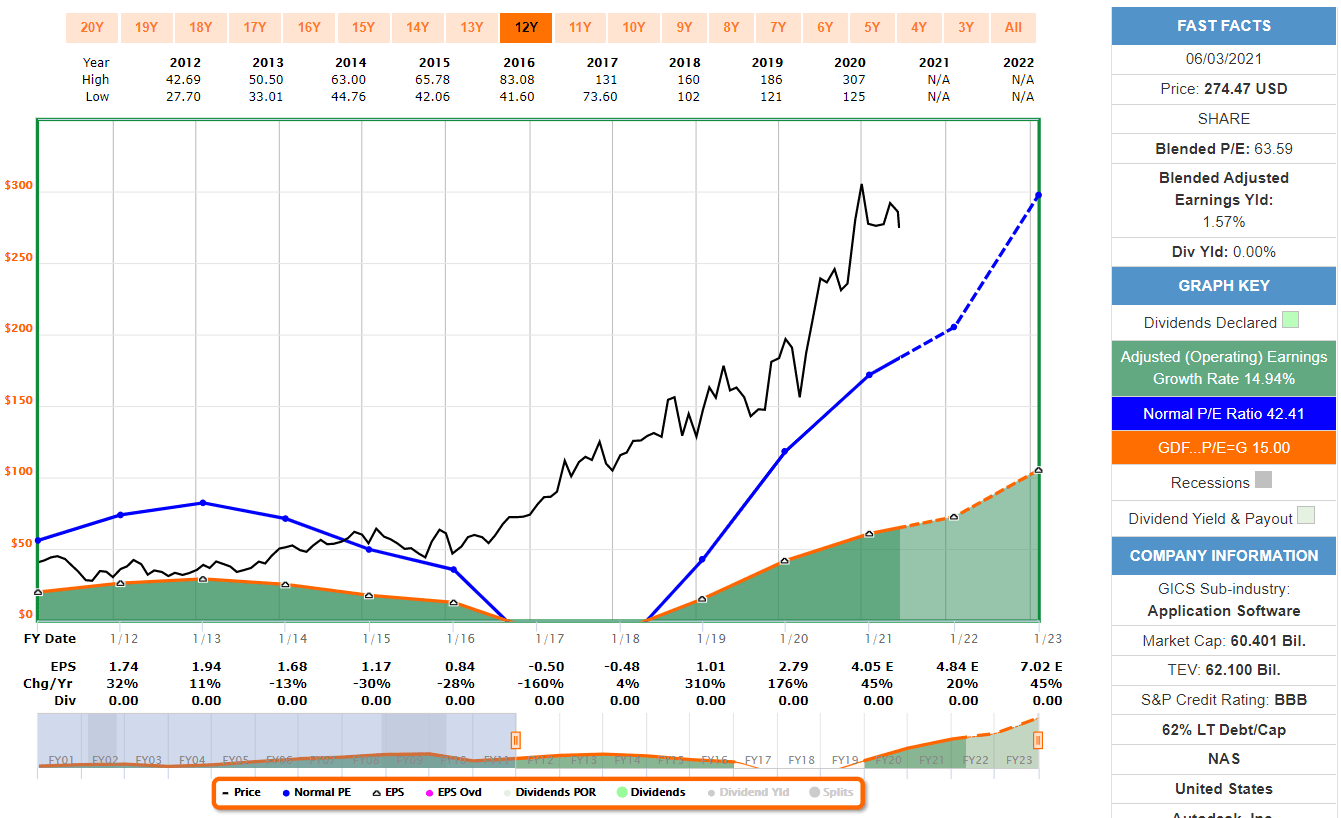

Systematic retrieval of data or other content from, whether to create or compile, post to other websites, directly or indirectly, as text, video or audio, a collection, compilation, database or directory, is prohibited absent our express prior written consent. Any other use, including for any commercial purposes, is strictly prohibited without our express prior written consent. (NASDAQ: ADSK) today announced the pricing of its first sustainability bond offering of an aggregate principal amount of 1 billion in 2.4 senior notes due 2031. You may use and the contents contained in solely for your own individual non-commercial and informational purposes only. This means that using the most recent 20 day stock volatility and applying a one standard deviation move around the stock's closing price, stastically there is a 67 probability that ADSK stock will trade within this expected range on the day. Liable for your own investment decisions and agree to the ADSK support price is 300.63 and resistance is 310.73 (based on 1 day standard deviation move). Users should not base their investment decision upon. is a research service that provides financial data and technical analysis of publicly traded stocks.Īll users should speak with their financial advisor before buying or selling any securities. Several short-term signals are positive, despite the stock being in a falling trend, we conclude that the current level may hold a buying opportunity as there is a fair chance for stock to perform well in the short-term. There is a buy signal from a pivot bottom found 19 days ago.) The RSI14 is 90 and this increases the risk substantially. (This stock has medium daily movements and this gives medium risk. A correction down in the nearby future seems very likely and it is of great importance that the stock manages to break the trend before that occurs. Regardless, the high RSI together with the trend position increases the risk and higher daily movements (volatility) should be expected. Normally this may pose a good selling opportunity for the short-term trader, but some stocks may go long and hard while being overbought. The Autodesk stock is overbought on RSI14 and lies in the upper part of the trend. For the last week, the stock has had a daily average volatility of 1.98%.

During the last day, the stock moved $5.03 between high and low, or 1.60%. This stock has average movements during the day and with good trading volume, the risk is considered to be medium. Support, Risk & Stop-lossĪutodesk finds support from accumulated volume at $310.19 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested. This is considered to be a good technical signal. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD). Further rise is indicated until a new top pivot has been found.

A buy signal was issued from a pivot bottom point on Monday, October 04, 2021, and so far it has risen 16.37%. A breakdown below any of these levels will issue sell signals. On corrections down, there will be some support from the lines at $311.72 and $290.85. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average. The Autodesk stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Mostly positive signals in the chart today.

0 kommentar(er)

0 kommentar(er)